Electric car tax credits can be highly valuable, but there are a lot of confusing rules regarding how they work. This guide will show you what you need to know about tax credits on plug-in electric vehicles. It will also answer some of the most common questions people have.

What is the Electric Car Tax Credits?

The Electric Car Tax Credits is a federal incentive built to encourage drivers to purchase an electric vehicle. This incentive is not a check you receive in the mail following a vehicle purchase, but rather a tax credit worth up to $7,500 that you become eligible for.

How Much are Electric Car Tax Credits?

All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a $7,500 federal income tax credit.

The amount of the credit will vary depending on the capacity of the battery used to power the car.

State and municipal tax breaks may also be available.

If you purchased a Nissan Leaf and your tax bill was $5,000, that’s all you get at the end of the year. You’re not going to get the other $2,500 as part of a refund. Furthermore, if part of the credit is unused, you can’t carry it over to the following year.

This credit only applies to purchases of a vehicle. If you happen to lease the vehicle, the manufacturer gets to take advantage of the tax credit instead. Some manufacturers will lower your monthly payment to take the credit into account, but they’re not obligated to do this.

The size of the battery in the car is one of the most essential criteria in determining how beneficial it is to claim the electric car credit. For example, the Toyota Prius Prime has a smaller battery, and it’s a hybrid, so you can only get a maximum of $4,502 from purchasing this vehicle.

How Much is the Electric Car Tax Credits for a 2022 Tesla?

The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an $8,000 (House version) or $10,000 (Senate version) refundable EV, electric vehicle tax credit while discouraging Chinese EVs from entering the US market.

Tesla, on the other hand, does not utilize unionized workers. Therefore it would be ineligible for the extra $2,500 (Senate version) or $4,500 (House version) credit that corporations like Ford and GM would get.

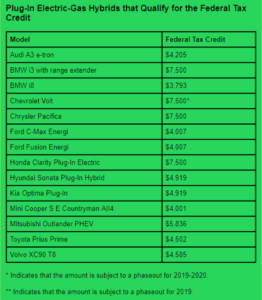

To help you understand how much each vehicle is worth, look at the chart below:

What Vehicles Currently Qualify for the Federal Credit?

Here are some popular models:

| Electric Vehicles | Federal Tax Credit |

| BMW i3 | $7,500 |

| Chevrolet Bolt | $7,500 (1/1/19-3/31/19) ($3,750, 4/1/19-9/30/19. $1,875, 10/1/19-3/31/20) |

| Fiat 500e | $7,500 |

| Ford Focus Electric | $7,500 |

| Hyundai Ioniq Electric | $7,500 |

| Kia Soul EV | $7,500 |

| Mercedes-Benz B-Class EV | $7,500 |

| Nissan Leaf | $7,500 |

| Tesla Model 3 | $3,750 (1/1/19-6/30/19) ($1,875, 7/1/19-12/31/19) |

| Tesla Model S | $3,750 (1/1/19-6/30/19) ($1,875, 7/1/19-12/31/19) |

| Tesla Model X | $3,750 (1/1/19-6/30/19) ($1,875, 7/1/19-12/31/19) |

| Volkswagen e-Golf | $7,500 |

| Plug-In Hybrids | Federal Tax Credit |

| Audi A3 e-tron | $4,205 |

| BMW i3 with range extender | $7,500 |

| BMW i8 | $3,793 |

| Chevrolet Volt | $7,500 (1/1/19-3/31/19) ($3,750, 4/1/19-9/30/19. $1,875, 10/1/19-3/31/20) |

| Chrysler Pacifica | $7,500 |

| Ford C-Max Energi | $4,007 |

| Ford Fusion Energi | $4,007 |

| Honda Clarity Plug-In Hybrid | $7,500 |

| Hyundai Ioniq Plug-In Hybrid | $4,543 |

| Hyundai Sonata Plug-In Hybrid | $4,919 |

| Kia Optima Plug-In | $4,919 |

| Mini Countryman S E All4 | $4,001 |

| Toyota Prius Prime | $4,502 |

| Volvo XC90 T8 | $4,585 |

Are There Any Terms and Conditions Associated With the EV Tax Credit?

There are additional rules involving EV tax credits. As well as the rule on how much you can get back from the Federal government, there are a few other things you must take into account:

The tax credit is awarded to the registered owner of the vehicle, which is why if you’re leasing, you can’t claim the credit. Instead, try to find a manufacturer that will factor the credit into your monthly repayments.

You can’t claim the credit if you’re buying an electric vehicle to resell it. However, this is almost impossible to prove, so plenty of people have claimed the credit anyway.

The vehicle’s primary purpose must be for driving within the US. In other words, if you live in Mexico, you can’t just buy in the US and immediately take it to Mexico, at least not for the first year.

Only cars built by qualified manufacturers are eligible for full credit.

Battery electric vehicles and plug-in hybrids must have battery packs that possess at least 4 kWh of energy storage. They must also be capable of being recharged from an external power outlet.

Manufacturers don’t have to certify their vehicles to the IRS that they meet the credit requirements. You can generally rely on manufacturers and their word as to whether a car is eligible. This also applies to electric motorcycles, three-wheel EVs, and other similar vehicles.

Please take note that the IRS is well within its rights to reject a request for a tax credit.

The car must have a qualified plug-in electric drive motor.

Do the Electric Car Tax Credits Expire?

The government has already begun to phase out electric vehicle tax credits. This is because sales volume is increasing, and they were introduced to encourage this industry.

There’s no set date for when Electric Car Tax Credits are due to expire. It depends on the manufacturer. This arises when a manufacturer sells 200,000 qualifying vehicles. Tesla was the first manufacturer to reach this limit back in July 2018.

That’s why from January 1st to June 30th, 2019, the tax credit has decreased by $3,750. From July 1st until the end of the year, the credit is only worth $1,875. From 2020, you won’t be able to claim tax credits on a Tesla.

General Motors became the second manufacturer to hit this milestone in the final financial quarter of 2018. From April 2019, qualifying vehicles are only worth $3,750 in tax credits. Then, from October 2019 to March 2020, the credit drops to $1,875. After that, the credit phases out completely.

Nissan is expected to be the third manufacturer to hit the limit, but as of this writing, it’s still 70,000 sales away from this. However, analysts expect sales to pick up soon.

Can You Refuse to Take Electric Vehicle Tax Credits?

This is a common question from people who want to pass the credit to someone else, such as if the car is used as a loan or test car.

The answer is you can’t pass electric vehicle tax credits to others. Even if the original owner didn’t claim the credit, the new owner can’t claim the credit.

This is especially important to know about if you plan on buying a used car. You may find that purchasing a new model is worth the additional cost because you’ll get more back from the tax credit.

Are There Any Expired Programs?

Hybrids and clean-diesel cars used to qualify for tax credits, but these were discontinued in December 2010. In addition, models like the Toyota Prius and the Hyundai Sonata Hybrid don’t have batteries that can be charged from an external source, so they’re no longer relevant for electric vehicle incentives.

Are There Any State Programs I Can Take Advantage Of?

Do remember that the Federal government is not the only body you can claim a tax credit from. There are dozens of programs run by states and even regions that can offer tax credits on electric cars and other vehicles that take advantage of alternative fuels.

Many states have multiple programs, but the problem is most of them apply only to businesses. A lot of credits are in the form of exemptions, such as inspections and fees. Some programs even offer access to carpool lanes and regional free or reduced parking.

Retail buyers do have some options, though. They can claim rebates, tax credits, and reductions on vehicle taxes by purchasing a qualifying vehicle.

California is one such state that does this. If you buy or lease a new car, like the Chevrolet Bolt or the Jaguar I-Pace, you can receive a rebate of $2,500. These programs are in addition to the Federal tax credit. So, Californians can shave off up to $10,000 off the cost of a new model.

On the other hand, Plug-in hybrids work a little differently because their batteries are smaller, and they burn some form of petroleum-based fuel most of the time. Cars like the Chevrolet Volt are only eligible for $1,500 rebates in California.

It would help if you looked up Plugin America for more information. They provide a map of the country and all the different plug-in car rebates, credits, and deductions. The Department of Energy also offers a similar resource.

Before you shop, look up what you may be entitled to. Unfortunately, many states have either ended or will soon end their programs. For example, Georgia ended its rebate program back in July 2015.

What about Fuel Cell Cars?

If you purchased a fuel cell car after January 1st, 2017, you’re no longer able to claim Federal tax credits on these cars. Those who bought before were able to get a Federal tax credit of $4,000, in addition to credits ranging from $1,000 to $4,000. After that, it largely depended on the fuel efficiency rating of the vehicle.

Some states still have these programs. For example, California continues to offer a $5,000 rebate on the Toyota Mirai.

How to Claim the Electric Car Tax Credit

Online tax software asks you simple questions to fill in the proper forms and helps you claim every electric car tax credit and deduction that you qualify for, and you will get the largest refund possible.

You never have to know the tax laws or rules during the filing process!

How do tax credits for electric cars work?

The Inflation Reduction Act, which passed the Senate this weekend, expands federal tax credits for electric vehicles. The bill removes a cap that prevents owners of popular electric vehicle manufacturers, such as Tesla and General Motors, from receiving the credit. It also expands the credit to used electric vehicles.

More than 7 million fully-electric or hybrid vehicles were registered in the US in 2021, according to data from the Department of Energy. Electric cars make up less than 4% of total passenger cars in the US. The federal government and some states provide tax incentives to individuals who purchase electric vehicles. These tax credits can add up to more than $10,000 in some states.

The Department of Energy defines electric-drive vehicles as those that “use electricity as their primary power source or to improve the efficiency of conventional vehicle designs.” From this definition, there are three major categories of electric vehicles: all-electric, plug-in hybrid, and hybrid[3]. Hybrid vehicles are the most popular, making up about 70% of all electric vehicle registrations in 2021.

How does the federal tax credit for electric vehicles work?

In 2010, Congress created the qualified plug-in electric vehicle credit, which offers up to $7,500[4] in tax credits for those who purchase new electric vehicles. Only fully electric and plug-in hybrid vehicles qualify for the federal tax credit program. Used and leased vehicles do not qualify.

The credits are nonrefundable, meaning they can only go toward reducing the taxes owed and cannot go towards a tax refund. So, if someone owes less than $7,500 in federal taxes, they wouldn’t get the full benefit of the credit when buying an electric vehicle.

There also is a cap on how many cars per manufacturer can qualify. After a manufacturer sells 200,000 vehicles, the credit begins to phase out. The cap is 200,000 vehicles total, not per year. Tesla and General Motors have met that cap, so any cars purchased by those manufacturers are currently not eligible for the credit.

In 2019, 162,686 returns claimed the tax credit, which is about 25% of qualified cars purchased that year. The average credit claimed per return was $3,952, slightly more than half the maximum amount.

How does the Inflation Reduction Act change federal tax credits for electric vehicles?

The Inflation Reduction Act will eliminate the 200,000-vehicle cap that prevented buyers of popular electric vehicle companies, like Tesla and General Motors, from receiving the credit. The bill also includes up to a $4,000 tax credit for used electric vehicles, which were previously not eligible.

The bill also adds some new restrictions on who can claim the tax credit. Higher income buyers will no longer be eligible for the tax credit, which will now be capped at $150,000 for single filers and $300,000 for joint filers.

There’s also a limit on which vehicles qualify for the credit. Cars costing more than $55,000 or pickups, SUVs or vans costing more than $80,000 will no longer be eligible. The law also limits the credit to vehicles assembled in North America as well as otherproduction related restrictions.

Which states have the most electric vehicles?

Almost 30% of all electric vehicles in the US are registered in California. California was also the first state to adopt a zero-emission vehicle policy that requires manufacturers to sell a set number of electric cars a year. By 2022, 13 states and Washington, DC will have enacted similar standards.

California has the most electric vehicles registered of any state.

State and local governments also provide monetary incentives for electric vehicle purchasers, in addition to the federal tax credit. These incentives include rebates, income tax credits, and excise or sales tax exemptions.

The most common type of state incentive are rebates, which pay a certain amount of money back to electric vehicle owners after the purchase of the car. Thirteen states offer rebates, the largest being Connecticut and Oregon, which provide up to $9,000 back to qualifying residents. Four states offer a state income tax credit like the federal program. Washington, Maryland, and Washington, DC offer excise or sales tax exemptions on the purchase of an electric vehicle.

Nineteen states and Washington, DC provide monetary incentives to electric vehicles owners.

In addition to tax credits and rebates for purchasing electric vehicles, some states provide additional incentives to electric vehicle owners. These can include exemptions from state emissions checks, access to high occupancy vehicle lanes, and discounts on highway tolls.

Utility companies at the state and local level also provide incentives for electric vehicle owners. These can include rebates for purchasing electric vehicles or chargers, specialty rates on electric bills, and discounts when charging cars at nonpeak hours.

Which states charge electric vehicle owners additional fees?

However, many states also charge additional fees for electric vehicle owners. These can range from about $50 per year to more than $300 per year.

Not every state provides a reason for the fees. But the two most cited reasons are to make up for the loss of gas tax revenue from electric vehicles or to help fund the expansion of electric vehicle charging stations. Gas tax revenue is often used to improve and maintain transportation infrastructure like highways and bridges.

Thirty-two states charge additional fees for electric vehicle owners

Pingback: Fastest Electric Car in the World 2022 - Best Electric Vehicle